Established in 2021

As a best investment and asset management company , we're playing a key role in the global economy. Our innovative fintech alternate investment platform helps create steady income, even during tough times, and provides investors with opportunities to achieve financial independence. Through our fractional investment model, we offer reliable business ideas in fast-growing markets, helping investors make smart decisions.

GHL‘sBusiness-Alternative Investment Platform

Gladden HelpLine India (GHL India) firmly believes in collective growth. Our fractional investment model provides opportunities for everyone to lead a stress-free life. Our growth experts always take actions that make our nation and people flourish.

Understand our Products

What We Do

Property Trading

GHL INDIA identifies the most demandable distressed properties at undervalued price and list the properties in our platform for funding from the investors. Once the required fund is mobilized, properties will be bought, developed, and sold to the ready buyers within a short span for substantial profit.

Since the properties are bought lower than the market value, they do not require any kind of appreciation immediately to make reasonable profit

The funds required for the business are raised as a debt through debenture issuance of a private limited company. This private limited company will be called a special purpose vehicle(SPV) as it looks after the specific business operation. The individuals or entities that purchase the debentures will be considered as lenders or creditors

The debt from the creditors is secured by way of charge/mortgage/hypothecation of asset

Wholesale Trading

GHL INDIA identifies the potential wholesale suppliers of seasonal consumable goods that have a minimum of 10 business clients like canteens at colleges, hospitals, and hotels to act as a soleselling agent for them

Once the terms are finalized with the wholesale suppliers, the plan will be listed on our platform for funding from the investors. With the raised funds, high-quality seasonal consumable goods will be bought directly from the farmers at very low cost and sold to the wholesale suppliers to make substantial profit for the agreed period

The funds required for the business are raised through an LLP firm as a capital contribution from the investors. This LLP firm will be called a special purpose vehicle(SPV) as it looks after the specific business operation. The individuals or the entities that invest in the LLP firm will be considered as simple partners

The capital contribution of the simple partners is secured by way of charge/mortgage/hypothecation of asset

Asset Under Management

Completed Projects

Satisfied Clients

Assistance Team

Repayments Made

Avg Returns Distribution

Default

Achievements

Media Presence

Sectors we invest

As primary, secondary, and tertiary sectors describe the economic activities of India,

The perpetual thriving sectors that we have chosen will depict our business activities.

Vital sectors we choose to gain more profit

- All

- Bio Tech

- Real Estate

- Agriculture

- Food & Beverage

Bio Tech

The Indian biotechnology industry is likely to reach US $ 150 billion by 2025. The biotechnology sector...

Read moreReal Estate

The real estate sector in India is expected to reach US $ 1 trillion by 2030. Rising international real estate...

Read moreAgriculture

The Indian agricultural sector is predicted to increase to US $ 24 billion by 2025. India can be among the top...

Read moreFood & Beverage

The FMCG market in India is expected to reach US $ 220 billion and is likely to be the fifth largest by 2025...

Read moreInvestment Plan

Secured Debenture -Sequel 9

| Minimum investment | ₹1,00,000 |

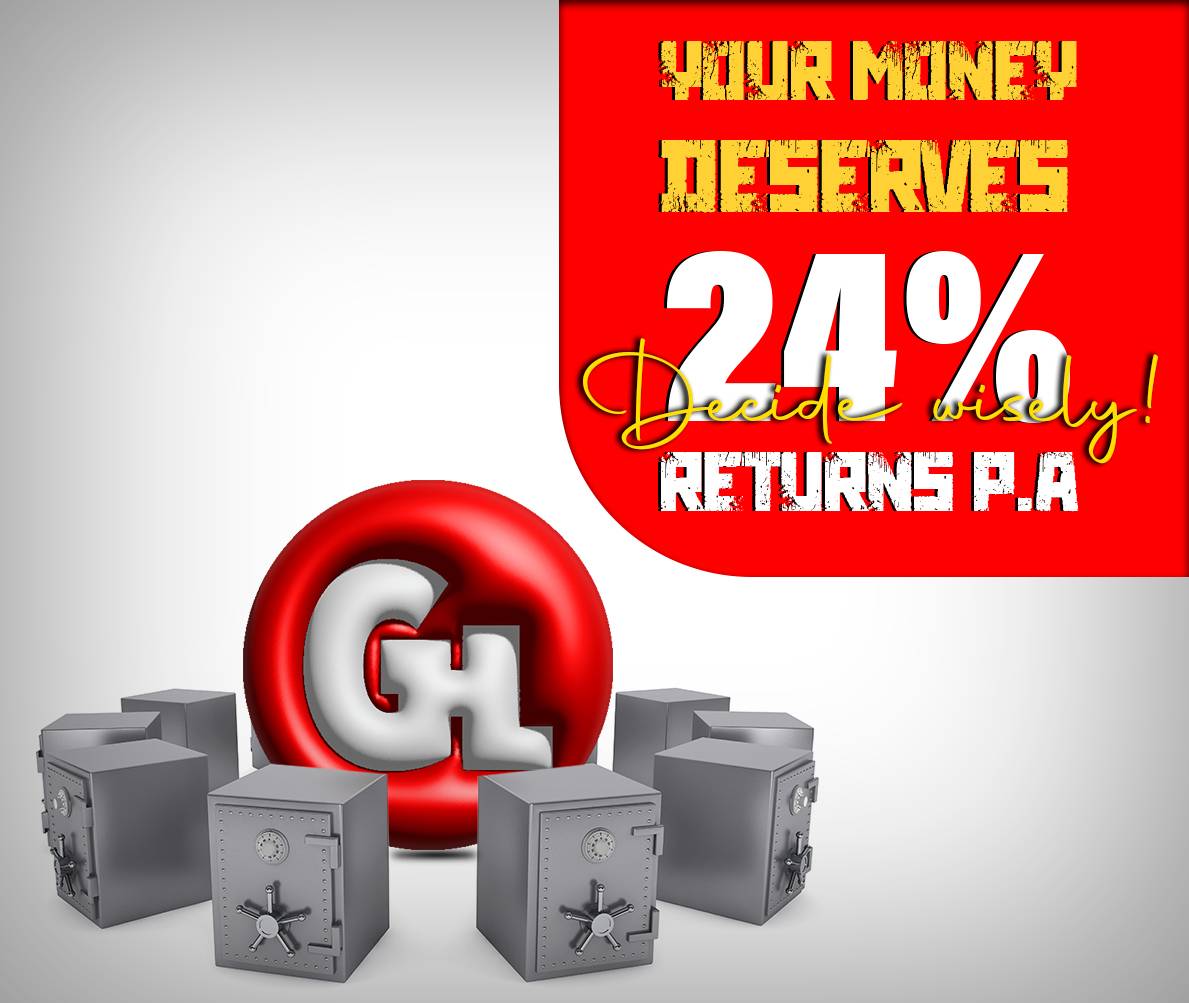

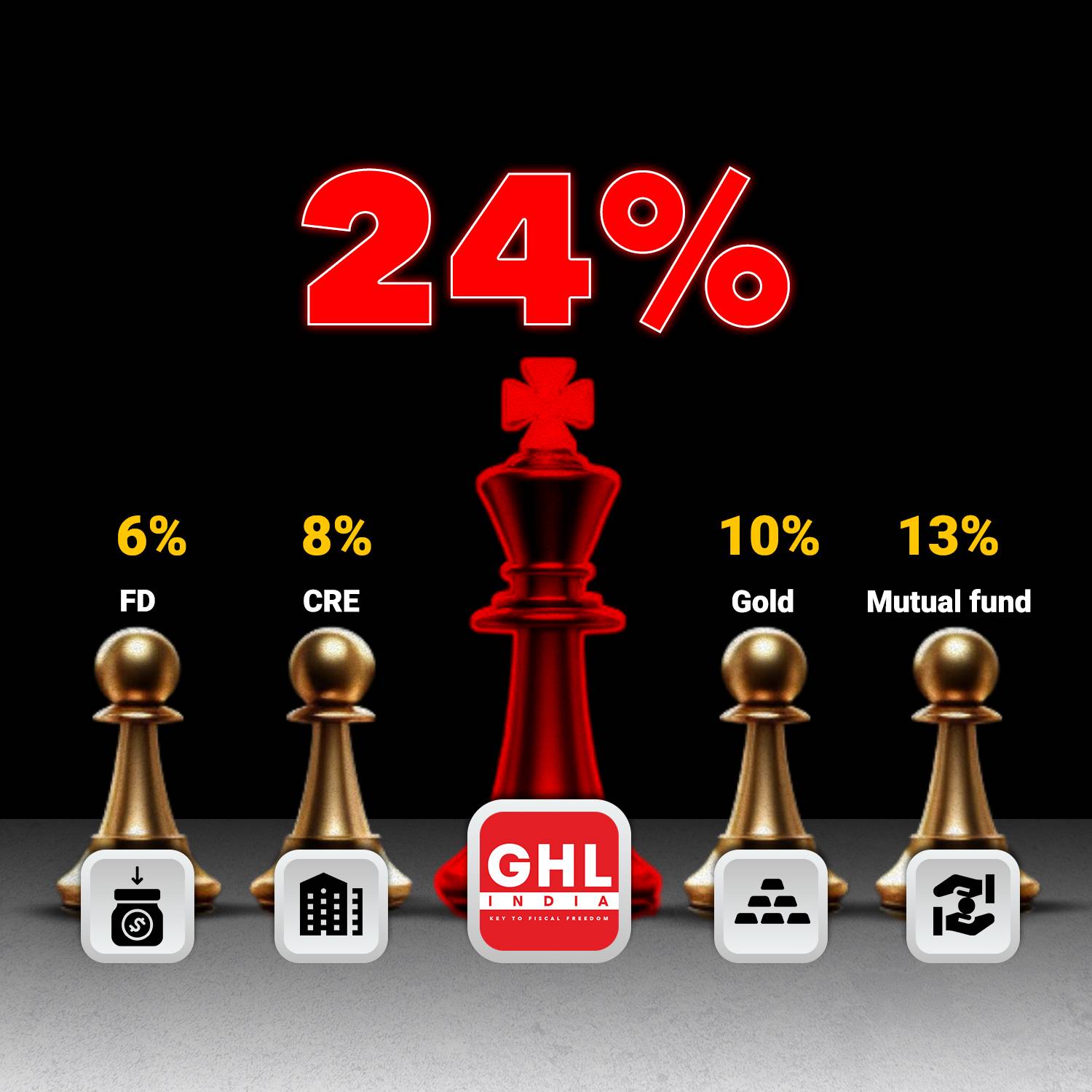

| Pre Tax Return | 24.00% (p.a) |

| Tenure | 24 Months |

| Total Fund Required | ₹13,90,00,000 |

| Total Fund Raised | ₹4,46,97,100 |

68% Yet to be Funded

HOW DOES IT WORK?

What Our Customers Say

Reviews

4.6 ⭐⭐⭐⭐⭐ (117)

Deepak

Deepak

Verified profile

Verified profile

7 months ago

⭐⭐⭐⭐⭐

"I invested on GHL India asset recently along with my dad. We are happy with the entire process right from start to finish. Teena was very helpful and proactive in answering all my questions during the onboarding process and afterwards, keeping me updated about the documents to sign and upload etc." Show More

Srinija G

Srinija G

Verified profile

Verified profile

8 months ago

⭐⭐⭐⭐⭐

"Best platform to invest money and get fixed returns with high securities and timely monthly returns. I enjoyed the cash back offer too. Smooth on board process and good relationship managers with good knowledge and transparent business structure. Highly recommend GHL india." Show More

K Reetika

K Reetika

Verified profile

Verified profile

a year ago

⭐⭐⭐⭐⭐

"GHL India is a great investment platform and excellent service is provided by the client support team. I have invested in the platform and received the payment on time. Their process is making sure the guarantee for the investment amount in terms of Debentures and providing the Bank Guarantee for the interest which grabbed by trust towards the company." Show More

Rafia Qadir

Rafia Qadir

Verified profile

Verified profile

a year ago

⭐⭐⭐⭐⭐

"I am delighted to share my positive experience with your services. The team demonstrated exceptional expertise, guiding me through strategic investment decisions. Their dedication to client success is truly commendable. I highly recommend GHL India for their professionalism and commitment to excellence." Show More

Varun Arora

Varun Arora

Verified profile

Verified profile

a year ago

⭐⭐⭐⭐⭐

"Just writing to say how excited I am to be going into investment with GHL India. Ms Razia (Business Development Manager) is always available to resolve my queries. I hope to do much more investment again soon!" Show More

Swathi Kiran

Swathi Kiran

Verified profile

Verified profile

9 months ago

⭐⭐⭐⭐⭐

"I recently got to know about GHL India company through my close friend and I have invested in debentures and wholesale trading. Will observe for more time before investing more amount and I recommend this company to invest your money too." Show More

Pavithra Kumar

Pavithra Kumar

Verified profile

Verified profile

6 months ago

⭐⭐⭐⭐⭐

"I recently got to know about GHL India company through my close friend and I have invested in secured debenture. Here my capital is secured by asset and the returns are secured by bank guarantee. I recommend this company to invest your money too." Show More

Arun Kumar

Arun Kumar

Verified profile

Verified profile

a year ago

⭐⭐⭐⭐⭐

"I had invested 1 lakh in GHL. All documentation was prompt, received in time and payment received regularly without fail. Will observe for more time before investing more money." Show More

Ajaya Panda

Ajaya Panda

Verified profile

Verified profile

10 months ago

⭐⭐⭐⭐⭐

"I have invested both in debentures and wholesale trading. Thanks for your timely monthly payments. Also thanks to my BDM Mr. Razia for his quick response whenever I have any query." Show More

Natarajan Arumugam

Natarajan Arumugam

Verified profile

Verified profile

5 months ago

⭐⭐⭐⭐⭐

"A diversified alternative investment platform. Been with the platform for about 6 months now. The customer support has been good and the returns are timely." Show More

Meena Meenu

Meena Meenu

Verified profile

Verified profile

7 months ago

⭐⭐⭐⭐⭐

"First of all I would like to thank my colleague Priya for referring this investment platform. I have invested in secured debenture where my money is safe, secured, and multiplied." Show More

dinesh odc

dinesh odc

Verified profile

Verified profile

10 months ago

⭐⭐⭐⭐⭐

"Getting returns on time, Bank guarantee and Agreement copies adds more value and Trustable for our investment." Show More

Deepak Dalal

Deepak Dalal

Verified profile

Verified profile

11 months ago

⭐⭐⭐⭐⭐

"Very good & safe opportunity for investment ghl india also better than bank fd investment" Show More

hemanth sai Bussetti

hemanth sai Bussetti

Verified profile

Verified profile

3 months ago

⭐⭐⭐⭐⭐

"It's been 10 months I invested 50000 and I'm getting interest every month so I trust them" Show More

Girish Kumar

Girish Kumar

Verified profile

Verified profile

3 months ago

⭐⭐⭐⭐⭐

"Sir, Thank you very much for showing your interest in our company's premium NCD investment plan. To know crystal clear information, Kindly contact 9150394446." Show More

Riddhiman Bajari

Riddhiman Bajari

Verified profile

Verified profile

2 months ago

⭐⭐⭐⭐⭐

"I have invested in GHL. I feel it is one of the most profitable investment opportunity." Show More

Jayesh Patil

Jayesh Patil

Verified profile

Verified profile

1 months ago

⭐⭐⭐⭐⭐

"Very good experience so far got on time credits." Show More

Harshad Shah

Harshad Shah

Verified profile

Verified profile

1 months ago

⭐⭐⭐⭐⭐

"Being a senior citizen the returns help me to meet my expenses." Show More

Sudhanshu Bharti

Sudhanshu Bharti

Verified profile

Verified profile

1 months ago

⭐⭐⭐⭐⭐

"Excellent" Show More

Nambiraj Krishnamoorthy

Nambiraj Krishnamoorthy

Verified profile

Verified profile

1 months ago

⭐⭐⭐⭐⭐

"Perfect innovative investment platform..." Show More

Om Prakash Dhakar

Om Prakash Dhakar

Verified profile

Verified profile

1 months ago

⭐⭐⭐⭐⭐

"Excellent improvement investment" Show More

Nayan Banik

Nayan Banik

Verified profile

Verified profile

10 days ago

⭐⭐⭐⭐⭐

"Well done 👍👍" Show More

Arun Klenten

Arun Klenten

Verified profile

Verified profile

15 days ago

⭐⭐⭐⭐⭐

"Getting returns on time, Bank guarantee and Agreement copies adds more value and Trustable for our investment." Show More

Joel Dmello

Joel Dmello

Verified profile

Verified profile

25 days ago

⭐⭐⭐⭐

"My investment journey with GHL has been rewarding. The timely payouts and transparent process have given me confidence in my decision. It's a reliable investment option for anyone looking for financial growth." Show More

Sunitha. Sangani0511

Sunitha. Sangani0511

Verified profile

Verified profile

20 days ago

⭐⭐⭐⭐

"Investing with GHL has been a great decision. The process was smooth, and the returns have been consistent. I feel secure knowing my investment is in good hands. Highly recommend it!" Show More

poovi thangaraj

poovi thangaraj

Verified profile

Verified profile

10 days ago

⭐⭐⭐⭐⭐

"GHL's investment options have provided me with financial stability. The process was easy, and the returns have exceeded my expectations. I highly recommend it to others looking for a secure investment." Show More

Shridhar Patil

Shridhar Patil

Verified profile

Verified profile

23 days ago

⭐⭐⭐⭐⭐

"Security and profitability were my top priorities, and GHL met both. 24% returns have helped me achieve my financial goals faster" Show More

Gopala Krishnan

Gopala Krishnan

Verified profile

Verified profile

22 days ago

⭐⭐⭐⭐⭐

"My secured debentures were added to my Demat account through CDSL without any trouble. The process was smooth and easy." Show More

sindhu boregowda

sindhu boregowda

Verified profile

Verified profile

12 days ago

⭐⭐⭐⭐⭐

"If you're new to investing, GHL is a great place to start. The team explains everything clearly, and the process is very smooth." Show More

Yogesh Selvaraj

Yogesh Selvaraj

Verified profile

Verified profile

24 days ago

⭐⭐⭐⭐⭐

"As a business owner, I invested 5 Lakhs in secured debentures. The returns 24% are great, and I’m happy with my choice." Show More

yuvasri m

yuvasri m

Verified profile

Verified profile

10 days ago

⭐⭐⭐⭐⭐

"I saw an investment opportunity in a YouTube ad and found it interesting. I contacted GHL for more details, and after learning more, I decided to invest in a secured debenture." Show More

Srinivas Nama

Srinivas Nama

Verified profile

Verified profile

9 days ago

⭐⭐⭐⭐⭐

"Harshini’s support has been incredible. She always answers my queries promptly and ensures I make informed investment decisions." Show More

Kaviyarasan M

Kaviyarasan M

Verified profile

Verified profile

8 days ago

⭐⭐⭐⭐⭐

"Priya is excellent at guiding investments. Her commitment and clear explanations make understanding the process easy and helpful. Kavi" Show More

thumbeja publicity

thumbeja publicity

Verified profile

Verified profile

7 days ago

⭐⭐⭐⭐⭐

"Investing in secured debentures was easy and smooth. The process was simple, and I’m happy with the returns." Show More

Surya Prakash

Surya Prakash

Verified profile

Verified profile

6 days ago

⭐⭐⭐⭐⭐

"After considering different options, I found GHL. The investment process is simple, and I’m happy with the results so far." Show More

ARUNGIREESAN MOORTHY

ARUNGIREESAN MOORTHY

Verified profile

Verified profile

5 days ago

⭐⭐⭐⭐

"Thanks to the 2% cashback, my investment feels even better. It's a great incentive, and I recommend it to anyone looking to invest." Show More

Gowtham 18

Gowtham 18

Verified profile

Verified profile

4 days ago

⭐⭐⭐⭐⭐

"I trust GHL because they deliver what they promise 24% returns, security, and proper documentation." Show More

Chella Kaliyappan

Chella Kaliyappan

Verified profile

Verified profile

3 days ago

⭐⭐⭐⭐

"The 2%cashback offer made my investment even It's a great deal,and I Really recommend it!" Show More

Murali M

Murali M

Verified profile

Verified profile

2 days ago

⭐⭐⭐⭐⭐

"The team is very professional and helpful. They explain everything clearly and ensure a smooth investment experience." Show More

Kirubakaran V

Kirubakaran V

Verified profile

Verified profile

1 days ago

⭐⭐⭐⭐⭐

"The support team is very helpful. They answer my questions quickly and make investing easy." Show More

pavan biradar

pavan biradar

Verified profile

Verified profile

today

⭐⭐⭐⭐⭐

"Great experience with GHL! Smooth process, good returns, and a supportive team." Show More

SAKTHI DURAI

SAKTHI DURAI

Verified profile

Verified profile

10 min ago

⭐⭐⭐⭐⭐

"If you’re looking for a secure and profitable investment, GHL is a great choice. Check it out!" Show More

anish roja

anish roja

Verified profile

Verified profile

10 hours ago

⭐⭐⭐⭐⭐

"I’m Anish. I’ve been investing for a year, and the 24% returns and security from GHL have exceeded my expectations, giving me confidence and satisfaction." Show More

ABISHEK G

ABISHEK G

Verified profile

Verified profile

6 hours ago

⭐⭐⭐⭐⭐

"Investing with GHL has been a smart choice. I see my savings growing & I’m happy with the results." Show More

Aravind S

Aravind S

Verified profile

Verified profile

6 hours ago

⭐⭐⭐⭐⭐

"As a doctor passionate about investing, I invested 30 lakh in secured debenture. The 24% returns was awesome, more than I expected, and the strong security gave me confidence, encouraging me to invest even more." Show More

Preetha Muthu

Preetha Muthu

Verified profile

Verified profile

5 hours ago

⭐⭐⭐⭐⭐

"Investing with GHL has been a smooth experience. The 24% returns are fabulous, and the extra cashback makes it even better!" Show More

034.santhosh OTAT

034.santhosh OTAT

Verified profile

Verified profile

5 hours ago

⭐⭐⭐⭐⭐

"This investment feels secure with multiple layers of protection. Having asset backing and MCA charge creation makes me feel my money is safe." Show More

Sowmiya

Sowmiya

Verified profile

Verified profile

3 hours ago

⭐⭐⭐⭐⭐

"Vani is great at making investments easy to understand. She is always available to clarify doubts and guide me in the right direction." Show More

PAVITHRA G

PAVITHRA G

Verified profile

Verified profile

3 hours ago

⭐⭐⭐⭐⭐

"Teena made my investment journey smooth and stress-free. Her clear explanations and prompt responses have been really helpful." Show More

Gowsalya Maha

Gowsalya Maha

Verified profile

Verified profile

1 hours ago

⭐⭐⭐⭐⭐

"GHL is a great option. They are professional, clear, and my investments have been growing well. I feel confident with them." Show More

Dhanumersal_

Dhanumersal_

Verified profile

Verified profile

2 days ago

⭐⭐⭐⭐⭐

"I needed an investment that paid regularly, and this one does just that! The 24% returns are steady and reliable" Show More

Ramani V

Ramani V

Verified profile

Verified profile

3 days ago

⭐⭐⭐⭐⭐

"The investment process was seamless, and I feel confident knowing it's backed by assets and registered with the MCA. I invested 15 lakh and received a PDC as security for my return on investment, making it a reliable and secure choice" Show More

Shreela P

Shreela P

Verified profile

Verified profile

1 days ago

⭐⭐⭐⭐⭐

"I saw this investment ad on YouTube and decied to learn more. I'm glad I did! The GHL team was very helpful, explained everything clearly, and I invested in a secured debenture" Show More

Mohandhanusika Dhanusika

Mohandhanusika Dhanusika

Verified profile

Verified profile

4 days ago

⭐⭐⭐⭐⭐

"I value the trust and openness GHL provides. Their investment process is clear, and I’ve experienced steady growth. It’s a great choice for building long-term wealth." Show More

SHATHARSINI SHATHA

SHATHARSINI SHATHA

Verified profile

Verified profile

7 days ago

⭐⭐⭐⭐⭐

"After considering different options, I found GHL. The investment process is simple, and I’m happy with the results so far." Show More

John Priya

John Priya

Verified profile

Verified profile

8 days ago

⭐⭐⭐⭐⭐

"Rafia has been really helpful with my investments. She explains things clearly and answers my questions quickly." Show More

RAKESH P

RAKESH P

Verified profile

Verified profile

8 days ago

⭐⭐⭐⭐⭐

"Investing in secured debentures was a good choice. The returns are stable, and I feel safe with my investment." Show More

Monesha Velayutham

Monesha Velayutham

Verified profile

Verified profile

10 days ago

⭐⭐⭐⭐⭐

"I was hesitant to invest at first, but the strong security, like Demat holding, asset backing, and MCA registration, gave me confidence. Now, I feel secure about my investment!" Show More

Jegatheesh M

Jegatheesh M

Verified profile

Verified profile

10 days ago

⭐⭐⭐⭐⭐

"Whenever I had questions, the support team was quick to assist me. Their guidance made my investment journey easier." Show More

Delhi Ganesh

Delhi Ganesh

Verified profile

Verified profile

11 days ago

⭐⭐⭐⭐⭐

"I’ve been investing here for a while now, and I’m pleased with how smooth everything is. The returns are consistent, and I feel secure about my investments. Highly recommended." Show More

Priya Dharshini

Priya Dharshini

Verified profile

Verified profile

11 days ago

⭐⭐⭐⭐⭐

"Investing in NCDs has been a safe and secure experience. The fact that they are held in my Demat account, backed by asset mortgages, and have charge creation with MCA gives me complete confidence in my investment" Show More

Mahi Manoharan

Mahi Manoharan

Verified profile

Verified profile

11 days ago

⭐⭐⭐⭐⭐

"I was happy to receive a 2% cashback on my investment. It’s a great benefit that adds more value." Show More

Guru__officl

Guru__officl

Verified profile

Verified profile

5 days ago

⭐⭐⭐⭐⭐

"My name is guru. This investment option is not just about qick profits; it’s a great choice for long-term financial security. I'm happy with my decision." Show More

Sugi 0025

Sugi 0025

Verified profile

Verified profile

9 days ago

⭐⭐⭐⭐

"I was unsure at first, but the strong protections made me feel safe. Holding my NCDs in my Demat account adds extra security." Show More

Dinesh Kumar

Dinesh Kumar

Verified profile

Verified profile

10 days ago

⭐⭐⭐⭐

"The process was smooth, and knowing my investment is backed by assets and registered with MCA makes me feel secure." Show More

Dhana Lakshmi

Dhana Lakshmi

Verified profile

Verified profile

5 days ago

⭐⭐⭐⭐⭐

"Razia’s advice has been valuable. She explains investment options well and helps in making informed decisions without any confusion." Show More

Sandhiya Sandhiya

Sandhiya Sandhiya

Verified profile

Verified profile

7 days ago

⭐⭐⭐⭐⭐

"I started wholesale trading with GHL, and my payouts always come on time. It’s a great and reliable investment." Show More

Mohandhanusika Dhanusika

Mohandhanusika Dhanusika

Verified profile

Verified profile

2025-03-24 14:34:28

⭐⭐⭐⭐⭐

"I value the trust and openness GHL provides. Their investment process is clear, and I’ve experienced steady growth. It’s a great choice for building long-term wealth." Show More

Ramani V

Ramani V

Verified profile

Verified profile

2025-03-24 15:17:47

⭐

"The investment process was seamless, and I feel confident knowing it's backed by assets and registered with the MCA. I invested 15 lakh and received a PDC as security for my return on investment, making it a reliable and secure choice" Show More

Dhanumersal_

Dhanumersal_

Verified profile

Verified profile

2025-03-24 15:18:52

⭐⭐⭐⭐⭐

"I needed an investment that paid regularly, and this one does just that! The 24% returns are steady and reliable" Show More

Shreela P

Shreela P

Verified profile

Verified profile

2025-03-24 15:23:54

⭐⭐

"I saw this investment ad on YouTube and decied to learn more. I'm glad I did! The GHL team was very helpful, explained everything clearly, and I invested in a secured debenture" Show More

Divija

Divija

Verified profile

Verified profile

2025-03-24 15:24:40

⭐⭐⭐⭐⭐

"GHL's investment plans are simple to understand and very clear. I feel confident about my investment, and I've already seen good growth. I plan to keep investing." Show More

Vinothini G

Vinothini G

Verified profile

Verified profile

2025-03-24 15:25:11

⭐⭐⭐⭐⭐

"The investment process was explained clearly, and my returns have been consistent. It's a safe and reliable choice for those seeking financial growth like me." Show More

Ravi Vimal

Ravi Vimal

Verified profile

Verified profile

2025-03-24 15:25:51

⭐⭐⭐⭐⭐

"I feel at ease knowing my investment is safe and well-protected. The extra security give me confidence in my decision." Show More

Divya

Divya

Verified profile

Verified profile

2025-03-24 15:26:19

⭐⭐⭐⭐

"Yes, I started with a small investment, but after seeing consistent returns, I invested more. The security and timely payouts make GHL a reliable investment partner." Show More

Kaviya

Kaviya

Verified profile

Verified profile

2025-03-24 15:26:55

⭐⭐⭐⭐

"Investing with GHL was a smart choice. Simple process, great returns!" Show More

Thirisha

Thirisha

Verified profile

Verified profile

2025-03-24 15:27:26

⭐⭐⭐⭐

"I wanted a safe investment, and GHL provided just that. The process was easy, and the 24% returns met my expectations. I’m happy with my choice to invest" Show More

Elavarasi Elavarasi

Elavarasi Elavarasi

Verified profile

Verified profile

2025-03-26 17:08:32

⭐⭐⭐⭐⭐

"I usually skip ads, but this one got my attention. I checked out GHL’s investment, talked to them, and it looked like a good opportunity. Glad I invested!" Show More

SIVAKAMI

SIVAKAMI

Verified profile

Verified profile

2025-03-27 10:40:22

⭐⭐⭐⭐

"I love how easy GHL makes investing! The team is friendly, the 24% returns are solid, and the cashback is a nice bonus." Show More

Fathima

Fathima

Verified profile

Verified profile

2025-03-27 17:07:26

⭐⭐⭐⭐

"The whole process was smooth and transparent. Knowing my investment is well-managed gives me confidence." Show More

Anitha Anitha

Anitha Anitha

Verified profile

Verified profile

2025-03-27 17:08:35

⭐⭐⭐⭐⭐

"GHL is a trustworthy option. Their team is professional, and my investments are growing well. I feel confident with them." Show More

Gowtham Shanmugam

Gowtham Shanmugam

Verified profile

Verified profile

2025-03-28 18:11:46

⭐⭐⭐⭐⭐

"Thanks to GHL, my financial situation has improved. The investment was simple, and the returns have been better than expected. Highly recommend it!" Show More

Mahalingam R

Mahalingam R

Verified profile

Verified profile

2025-03-28 18:12:34

⭐⭐⭐⭐

"I wanted to invest a year ago but was held back by fear and uncertainty. However, after leaning about GHL's investment opportunities, my confidence grew. The support team was incredibly helpful, making the process much easier." Show More

Deepan Deena0803

Deepan Deena0803

Verified profile

Verified profile

2025-03-28 18:13:24

⭐⭐⭐

"I started wholesale trading, and my payouts always come on time. It’s a good and reliable investment." Show More

V.R.pranesh balaji Balaji

V.R.pranesh balaji Balaji

Verified profile

Verified profile

2025-03-28 18:14:28

⭐⭐⭐⭐

"The payouts are always on time, and the transparency is impressive. I trust them completely and would recommend them to anyone!" Show More

Hari Priya

Hari Priya

Verified profile

Verified profile

2025-03-28 18:15:23

⭐⭐⭐⭐⭐

"As a first-time investor, I was unsure about where to start. But GHL made everything simple and easy to understand. I now feel confident about investing!" Show More

Swetha Murugesan

Swetha Murugesan

Verified profile

Verified profile

2025-03-28 18:16:16

⭐⭐⭐⭐

"As an entrepreneur, finding a secure investment was crucial for me. GHL’s secured debentures provided both safety and profitability. The 24% returns have been impressive, and I look forward to investing more." Show More

David Billa

David Billa

Verified profile

Verified profile

2025-03-29 15:07:33

⭐⭐⭐⭐⭐

"I feel confident about this investment because of its strong security. With asset backing and MCA registration, I know my money is in safe hands" Show More

E. Thrikesh

E. Thrikesh

Verified profile

Verified profile

2025-03-29 15:08:59

⭐⭐⭐⭐

"GHL is a trustworthy company. They are professional, clear, and I’ve had a smooth experience with them" Show More

Kayal

Kayal

Verified profile

Verified profile

2025-04-01 12:33:09

⭐⭐⭐⭐⭐

"My investment experience with GHL has been smooth. The 24% returns are make me feel satisfied, and the cashback bonus makes it even better!" Show More

Vinitha S

Vinitha S

Verified profile

Verified profile

2025-04-03 17:37:44

⭐⭐⭐⭐

"This is vinitha. My investment in secured debentures faced a small delay, but I received my bank guarantee, and the 24% returns were worth the wait." Show More

mathan Ak

mathan Ak

Verified profile

Verified profile

2025-04-03 17:39:36

⭐⭐⭐⭐⭐

"As a small business owner, I decided to invest to grow my funds. I invested 5 Lakhs in secured debentures, and the returns have been impressive. I’m very satisfied" Show More

JITHENDRI B

JITHENDRI B

Verified profile

Verified profile

2025-04-03 17:41:07

⭐⭐⭐⭐⭐

"I’m really happy with my investment in GHL. The process was straightforward, and my returns have been consistent. I feel confident about the security of my investment." Show More

Raghul Nrir

Raghul Nrir

Verified profile

Verified profile

2025-04-03 18:29:20

⭐⭐⭐⭐⭐

"The 2% cashback incentive has really made my investment more rewarding. It’s a great extra benefit, and I would recommend it to anyone thinking of investing" Show More

SOUNDAR

SOUNDAR

Verified profile

Verified profile

2025-04-03 18:30:46

⭐⭐⭐⭐

"I invested knowing about the 24% returns, but the 2% cashback made it even more exciting. A great opportunity!" Show More

M.P. Karthik

M.P. Karthik

Verified profile

Verified profile

2025-04-04 12:13:36

⭐⭐⭐⭐

"The added security features like asset backing and MCA charge creation have made me feel really confident in my investment. Thanks to GHL!" Show More

Manoj Manoj

Manoj Manoj

Verified profile

Verified profile

2025-04-05 18:34:41

⭐⭐⭐⭐

"This is the best alternative investment I have ever seen. The process was smooth, and the returns have been consistent. I highly recommend it!" Show More

Naveen kumar P

Naveen kumar P

Verified profile

Verified profile

2025-04-25 18:46:02

⭐⭐⭐⭐⭐

"I recommended my friend and received a bonus. It’s rewarding to share investment opportunities with others." Show More

kala thangam

kala thangam

Verified profile

Verified profile

2025-05-23 12:26:51

⭐⭐⭐⭐

"I’m Kala Thangaraj. Initially, I had some doubts about investing, but after exploring GHL’s offerings, I felt more confident. Their helpful suport team guided me through the process. I decided to invest in wholesale trading, and I’ve been receiving timely payouts, which has made it a dependable choice for me." Show More

Naveen Naveen

Naveen Naveen

Verified profile

Verified profile

2025-05-23 12:30:02

⭐⭐⭐⭐

"The support team is very friendly and quick to respond. They answered all my questions and made investing simple." Show More

Anjou Akash

Anjou Akash

Verified profile

Verified profile

2025-05-23 12:32:41

⭐⭐⭐⭐

"I am always looking for investments that offer security and great 24% returns, and GHL has made this wish come true. Thanks for providing such a wise opportunity!" Show More

Arun Kumar

Arun Kumar

Verified profile

Verified profile

2025-05-23 12:36:36

⭐⭐⭐⭐

"My experience with GHL has been really good. The investments are easy, the payouts are timely, and I feel confident about my money growing with them." Show More

Sharmila Loganathan

Sharmila Loganathan

Verified profile

Verified profile

2025-05-23 12:39:09

⭐⭐⭐⭐

"GHL is a great option for investing . They are professional, clear, and trustworthy!" Show More

Ghost Sangesh

Ghost Sangesh

Verified profile

Verified profile

2025-05-23 12:43:46

⭐⭐⭐⭐⭐

"I started investing in wholesale fruit and vegetable trading with GHL, and it’s been a great experience. The process is easy, and the payouts come on time." Show More

Kavin Kumar

Kavin Kumar

Verified profile

Verified profile

2025-05-23 12:45:35

⭐⭐⭐

"My name is Kavinkumar. This investment has met all my expectations. The process was easy, and the returns have been consistent. I’m confident in my investment and would highly recommend it to anyone." Show More

Jaya Susi

Jaya Susi

Verified profile

Verified profile

2025-05-24 12:36:31

⭐⭐⭐⭐⭐

"Dharshana support has been amazing! She is always patient and answers all my questions clearly." Show More

thirumalai pandi

thirumalai pandi

Verified profile

Verified profile

2025-05-24 12:39:49

⭐⭐⭐

"I’m really happy with my decision to invest with GHL. The 24% returns are impressive. It’s great to have found an investment that perfectly matches my goals" Show More

Arul Priya

Arul Priya

Verified profile

Verified profile

2025-05-24 12:42:49

⭐⭐⭐

"I came to know about the investment through one of my friends, and I am very grateful to have found such a wise investment that I had always been seeking!" Show More

Karnan Bharath

Karnan Bharath

Verified profile

Verified profile

2025-06-16 15:43:21

⭐⭐⭐⭐⭐

"As someone new to investing, I had a lot of doubts. But Dharshana explained everything clearly, and the team supported me throughout. I now feel confident and I’m earning 24% a year" Show More

MR. KUTTY

MR. KUTTY

Verified profile

Verified profile

2025-06-16 15:46:01

⭐⭐⭐⭐⭐

"GHL really surprised me. Not only do I get great returns, but the support I received from their team was awesome. I’ve never experienced such professionalism and care before." Show More

spar TN29 Agilesh

spar TN29 Agilesh

Verified profile

Verified profile

2025-06-16 15:54:29

⭐⭐⭐⭐⭐

"I’m a dentist, and I don’t have time to manage my investments. GHL’s structured process and reliable 24% returns have made it so easy for me to grow my savings." Show More

Dineshkumar Durai

Dineshkumar Durai

Verified profile

Verified profile

2025-06-16 16:00:00

⭐⭐⭐⭐⭐

"I was looking for an investment that gave high returns without high risk. GHL gave me exactly that. The 24% p.a. returns have been consistent, and their process is very transparent." Show More

Deva Raina

Deva Raina

Verified profile

Verified profile

2025-06-16 16:03:16

⭐⭐⭐⭐⭐

"I've collaborated with a lot of banking institutions, but none seemed as personal as GHL. The team is patient and honest, and the annual return of 24% has been consistent" Show More

ranju 1602

ranju 1602

Verified profile

Verified profile

2025-06-16 16:06:51

⭐⭐⭐⭐

"What I liked most is how Dharshana simplifies everything. Even though I had a lot doubts, I understood the investment clearly. And now I’m enjoying the benefits of 24% yearly returns." Show More

Mohan Sakthi

Mohan Sakthi

Verified profile

Verified profile

2025-06-16 16:09:59

⭐⭐⭐

"As a working professional, I needed a passive income stream. GHL helped me get started with ease, and I’m now earning 24% annually without stress." Show More

Sk Sathees

Sk Sathees

Verified profile

Verified profile

2025-06-17 14:35:15

⭐⭐⭐⭐⭐

"I've been investing here for a while now, and I'm pleased with how smooth everything is. The returns are consistent, and I feel secure about my investments." Show More

Gobika Dhakshinamoorthy

Gobika Dhakshinamoorthy

Verified profile

Verified profile

2025-06-18 11:26:20

⭐⭐⭐

"What stood out for me was the support. Any time I had a doubt, the support team helped immediately. And yes - the 24% p.a. returns are real." Show More