Do you know what is charge creation?

Charge creation is when a borrower uses specific assets as security to guarantee repayment. This gives lenders confidence that their money is safe, even if the borrower can't pay back the debt. It helps reduce risk and builds trust in the deal.

How is the charge creation process done for debenture plan?

Ever wondered how charge creation works in debenture plans?

DEBENTURE PLAN

A group of entrepreneurs wants to build a warehouse and needs money. They decide to raise funds by issuing debentures and put the money into their Special Purpose Vehicle (SPV) account.

With the money ready, they use it to buy land for the warehouse, with the land owned by the SPV. They then appoint a debenture trustee, a person or organization that will manage the loan and ensure everything runs smoothly. To protect the loan, they mortgage the land in the trustee's name, making sure the land can be used to pay back the loan if needed. Finally, they register the mortgage deed with the Ministry of Corporate Affairs (MCA), securing the deal through the CHG-9 charge creation form.

Now they have the funds, the land, and the proper legal steps to move forward.

How is the charge creation process done for LLP plan?

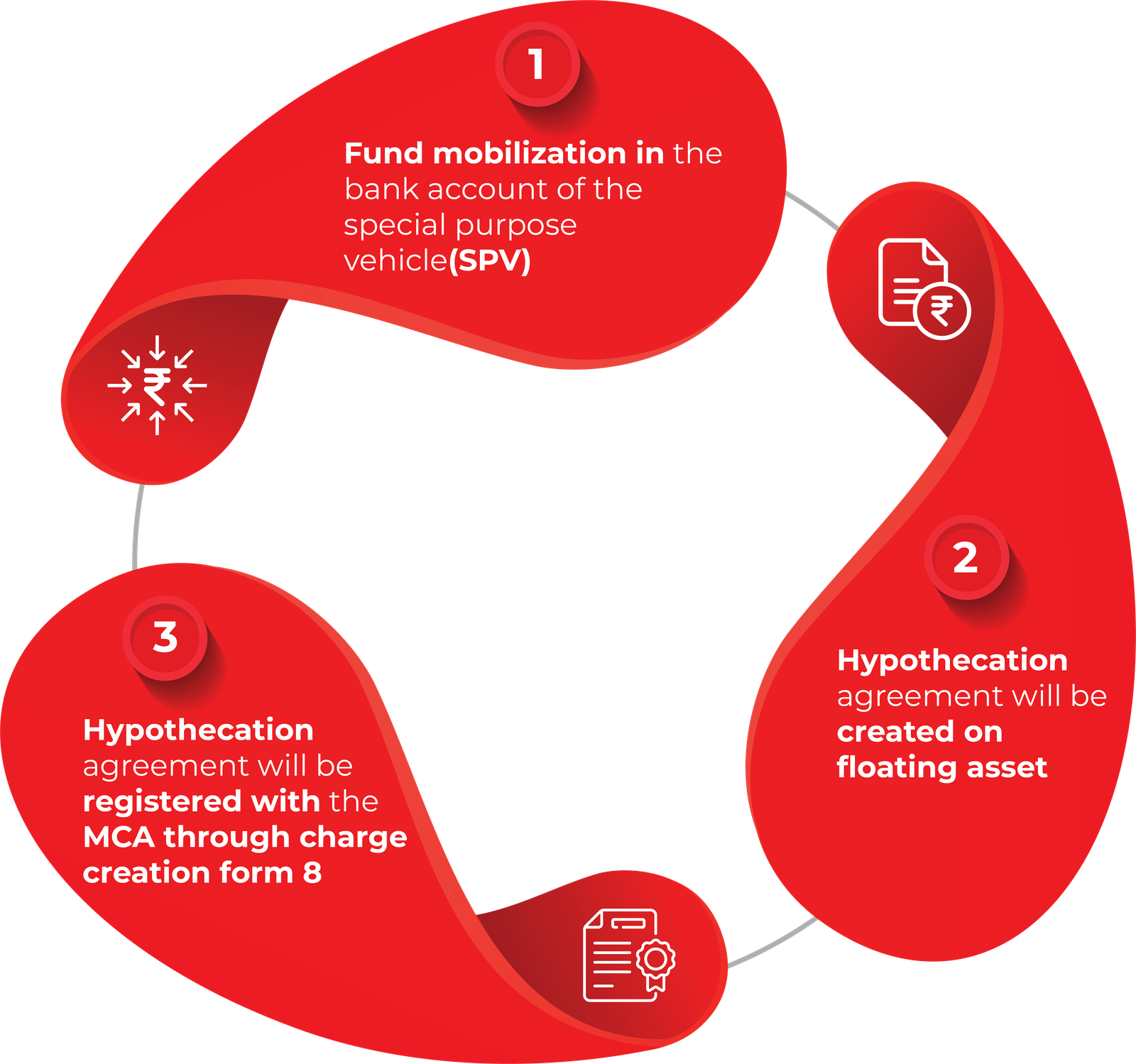

LLP Fund Mobilization and Hypothecation Agreement Process

1. Fund Mobilization:

Funds are mobilized in the bank account of the Special Purpose Vehicle (SPV) to initiate the f inancing process.

2. Hypothecation Agreement on Floating Assets:

A hypothecation agreement is created on the floating assets, ensuring that the lender has a charge over the assets provided by the borrower.

3. Registration of Hypothecation Agreement:

The hypothecation agreement is officially registered with the Ministry of Corporate Affairs (MCA) via Charge Creation Form 8 to provide legal binding and transparency.

How GHL Secures Your Assets?

Once a charge is placed on an asset, it can't be sold without approval. If GHL India decides to sell the asset, we'll make sure to pay back all investors or replace it with something of equal value to keep your investment safe.

With our charge creation services, GHL India makes sure your capital is fully protected. We're dedicated to creating a secure and prosperous future for everyone.