It’s time to decide: Are you heading for a budget shortfall or building a budget surplus?

If you’re choosing a budget surplus, what’s your next move? Your next step is to focus on protecting and managing your money wisely.

Let’s dive into some valuable budgeting lessons Robert learned from his rich dad and other wealthy mentors about creating a budget surplus.

First tip: Treat a budget surplus like an expense.

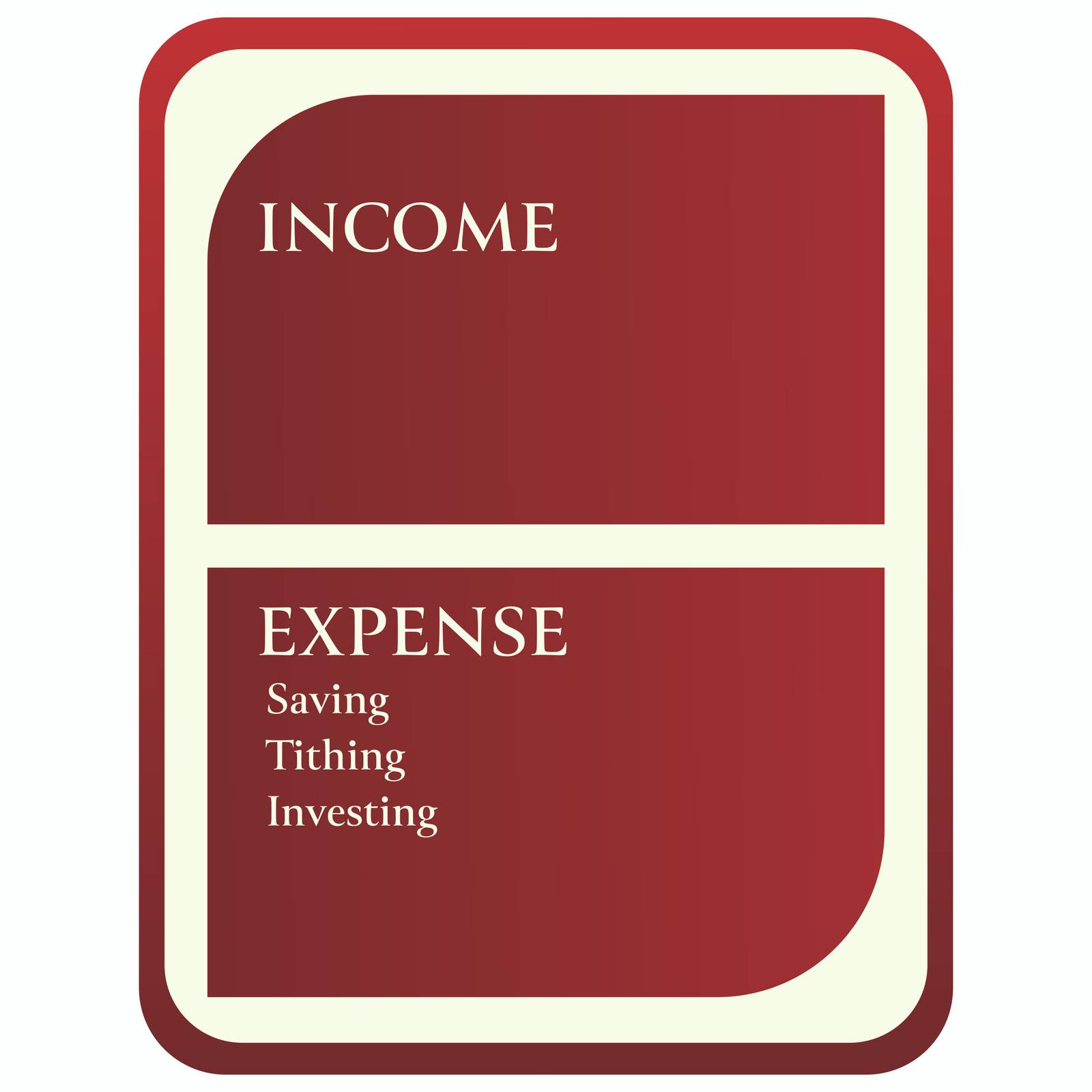

‘Make your surplus an expense’—the best advice Robert got from his rich dad. With this mindset, here’s how his financial statement looked:

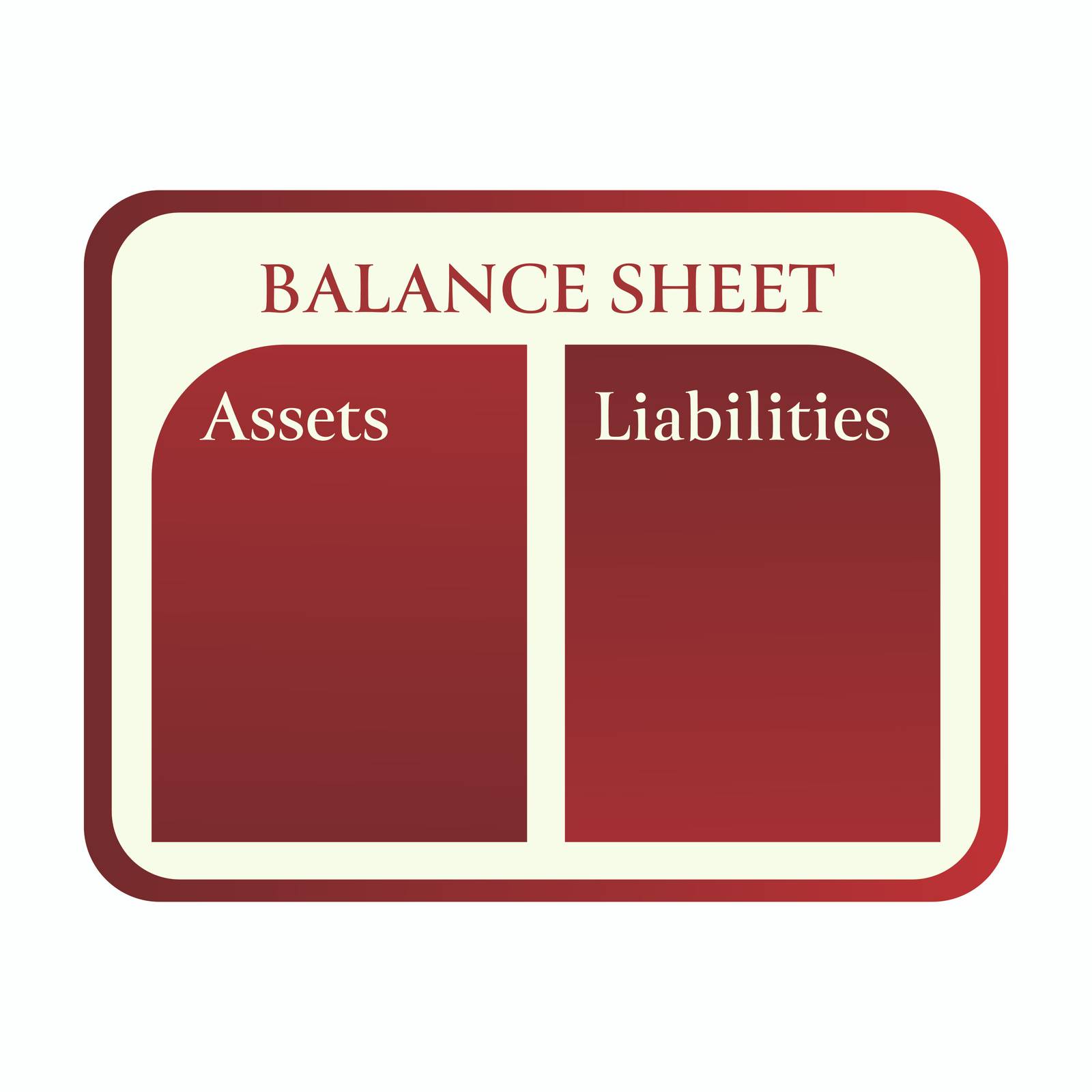

He also explains, 'The reason governments, businesses, and individuals fail to create a budget surplus is because they imagine a budget surplus looks like this:’

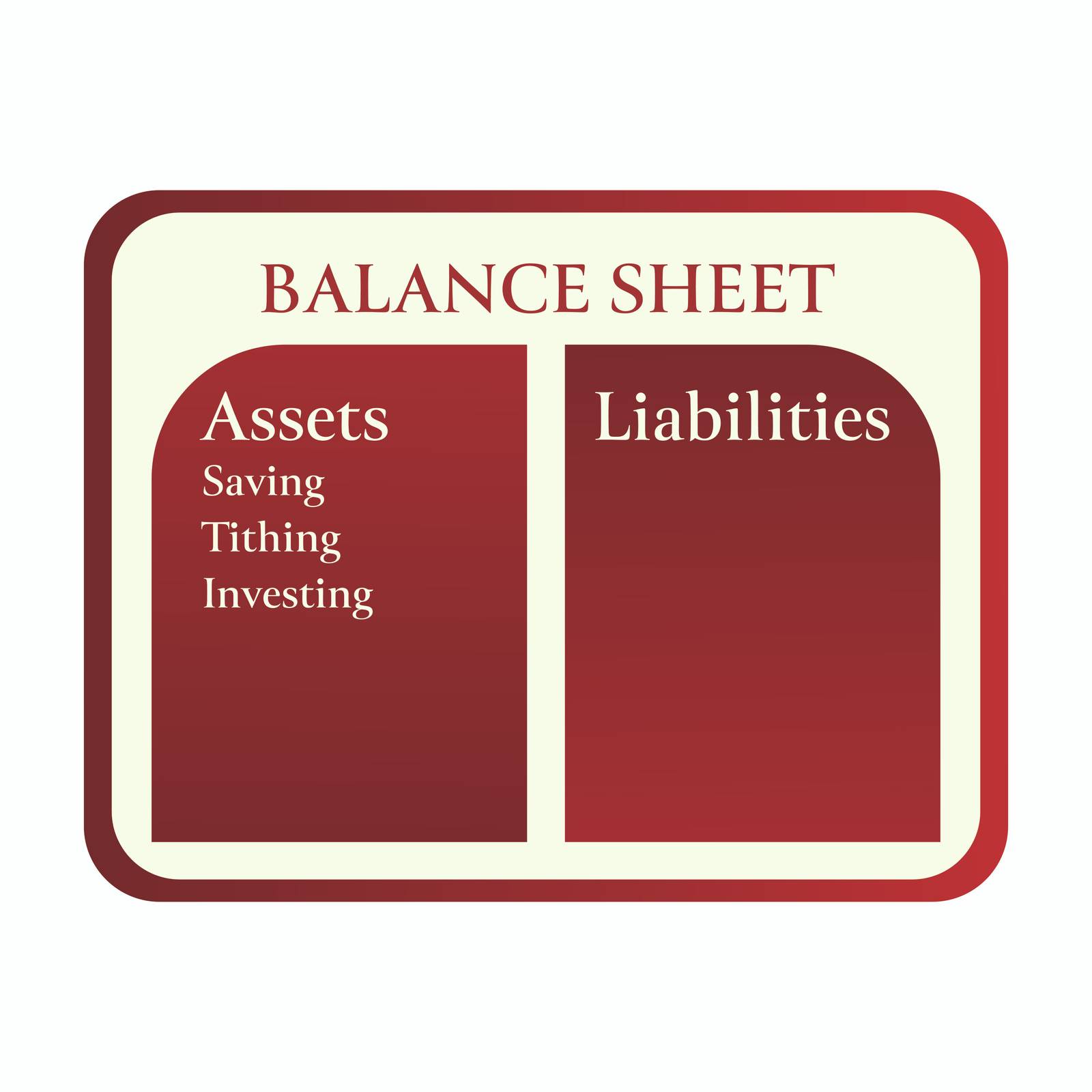

The first diagram represents paying yourself first, while the second shows paying yourself last.

Do you know where the middle class often falls short? It’s all about setting the right priorities.

For most middle-class individuals, financial priorities look like this:

- Get a high-paying job

- Make mortgage and car payments

- Pay bills on time

- Save, tithe, and invest

But here’s the key: A surplus must be a priority! To achieve this, make saving, tithing, and investing at least your second priority and treat them as expenses in your financial plan.

Here’s how Kim and Robert handle their money:

In 1989, Kim bought her first rental property, investing $5,000 and earning $50 in positive cash flow. Robert says that if they hadn’t prioritized investing as an expense and paid themselves first, they’d still be prioritizing everyone else.

Instead of holding cash in a retail bank, they saved through investments in gold, silver, and other funds.

Robert explains, 'Most people don’t prioritize saving for themselves because there’s no immediate penalty—no bill collector calls, and there’s no threat of losing anything. But we respond to pressure from creditors, so we use that same kind of pressure on ourselves to push us to earn more and grow our income.’